Non-commercial profits (NCBs): actual tax regime

Verified 27 August 2025 - Directorate of Legal and Administrative Information (Prime Minister), Ministry of Finance

Where a natural person subject to income tax (IR) receives income from a self-employed activity, that income is non-commercial profit (NCB). There are 2 tax regimes that depend on the amount of turnover collected: micro-NCB and controlled reporting.

Non-commercial profits (NCBs) correspond to receipts of which the the following charges were deducted :

- Rent of business premises

- Depreciation

- Rents paid for the performance of a contract of leasing or renting a vehicle

- Expenditure incurred for the keeping of accounts (e.g. chartered accountant) and/or membership in an approved association taken into account by a tax credit

- Expenditures made for obtain a diploma or professional qualification in the context of a professional integration or retraining. This concerns people who earn income from playing a sport

- Rents paid for the performance of a lease or rental of a building

- Transfer duties free of charge paid by the heirs, donees or legatees of a holding and interest paid

- Regular installments for product design of intellectual property (example: patents, trademarks, designs, etc.)

Non-commercial profit earners (NCBs) include:

- Individual Contractor (IC) engaged in a liberal activity

- Office holders and offices practicing a non-commercial profession (lawyers at the Council of State and the Court of Cassation, notaries, bailiffs, auctioneers, registrars of commercial courts, etc.)

- Individual receiving income from intellectual property (e.g. copyright collected by the author or his heirs)

- Legal representative an income tax business (for example, manager of a LLC subject to the RI)

Warning

If an individual contractor has opted for assimilation to a EURL, it is subject to business tax (IS) and is no longer subject to the rules on the taxation of non-commercial profits (NTB).

Where the annual turnover excluding tax (VAT), which corresponds to non-commercial profits (NCB), is less than €77,700, it's the special micro-BNC regime (micro-company) applicable.

Beyond this threshold, it is the controlled reporting regime which applies.

In this fact sheet, only the controlled reporting regime is discussed. To learn more about the micro-BNC diet (micro-company diet), you can consult the dedicated sheet.

Ouvrir l’image dans une nouvelle fenêtre

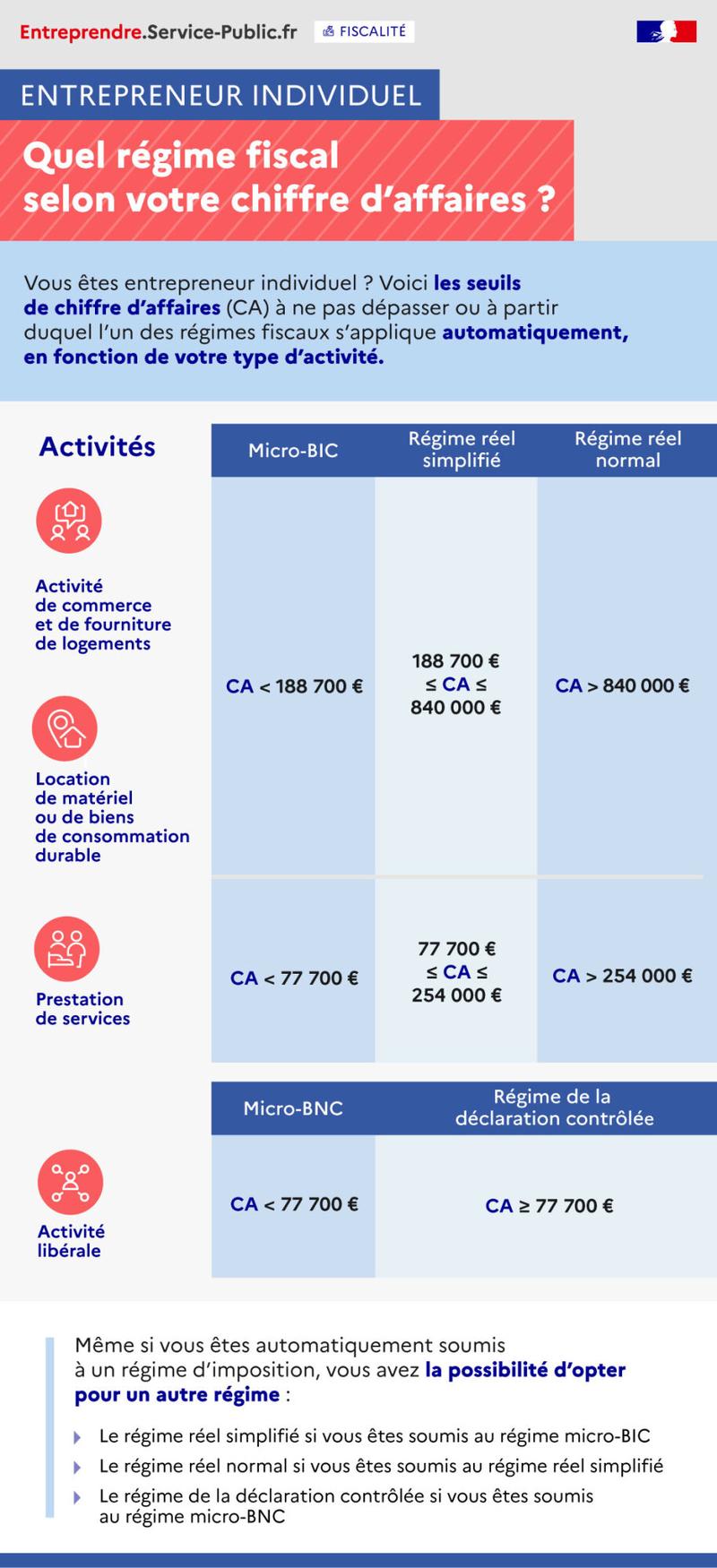

Are you an individual entrepreneur? Here are the turnover thresholds (turnover thresholds) that should not be exceeded or from which one of the tax regimes applies automatically, depending on your type of activity.

Activities | Micro-BIC | Simplified real regime | Normal Real Speed |

|---|---|---|---|

Micro-BNC | Regime of controlled reporting | ||

Trade and supply of housing | TURNOVER < €188,700 | 188 700€ ≤ CA ≤ 840 000€ | TURNOVER > €840,000 |

Rental of equipment or consumer goods | |||

Provision of services | REVENUE < €77,700 | 77 700€ ≤ CA ≤ 254 000€ | TURNOVER > €254,000 |

Liberal activity | REVENUE < €77,700 | CA ≥ €77,700 | |

Even if you are automatically subject to a tax regime, you can opt for another regime:

- The real simplified diet if you are subject to the micro-BIC diet

- The normal real regime if you are subject to the simplified real regime

- The controlled reporting regime if you are subject to the micro-BNC regime

The documents to be sent on the tax return depend on the shape of the company:

Répondez aux questions successives et les réponses s’afficheront automatiquement

Individual contractor

The contractor subject to the controlled return system must send the following documents at the time of his tax return:

- Supplementary income tax return No. 2042 C pro under the heading ‘controlled reporting arrangements’ at the time of his tax return on its special account of the site impôt.gouv.fr.

- NCB 2035 income statement and Annexes 2035 A and 2035 B at most late 15 days after on 2e working day after 1er May. It must be made by the EDI-TDFC procedure or on the online tax account for professionals (EFI mode) .

When filing an income tax return, the individual entrepreneur must complete a “social” component in which he indicates the income that is used as a basis for calculating his social contributions.

Income tax return: self-employed people can now correct their social data online

Entrepreneurship - News

Pour en savoir plus

Business subject to IR

The business subject to the controlled return system must send the following documents at the time of his tax return:

- Supplementary income tax return No. 2042 C pro under the heading “Controlled return scheme” at the time of the officer's income tax returnon its special account of the site impôt.gouv.fr.

- NCB 2035 income statement and Annexes 2035 A and 2035 B at most late 15 days after on 2e working day after 1er May. It must be made by the EDI-TDFC procedure or on the online tax account for professionals (EFI mode) .

The business must also attach using the Form No. 2035-AS-SD the list of persons holding at least 10% of its capital. The following information should be specified:

- Each natural person: number of shares held, holding rate, surname, first names, address, date and place of birth

- Each business: number of units or shares held, ownership ratio, company name, address and SIRET

It must also provide a list of its subsidiaries and their holdings, specifying for each of them the holding rate and its Siret number.

FYI

In the case of revaluation of fixed assets, a table of fixed assets and depreciation showing increases in value must also be attached. Depreciation margin surcharges should also be indicated.

Lack of or delay in reporting

The company who does not forward its declaration of result receives a formal notice of the tax administration. If it does not regularize its situation within 30 days, it exposes itself to a compulsory taxation.

In case of delay or to transmission fault reporting of results, a mark-up is applied. The company is liable to one of the following sanctions depending on its situation:

- Markup of 10% where the declaration has been lodged after formal notice within the 30-day period

- Markup of 40% where the declaration has not been lodged within 30 days or where there has been a deliberate failure to comply

- Markup of 80% in the event of fraudulent tactics or abuse of rights

Incomplete declaration

The company may also be penalized in the following cases:

- Document supplementary to the declaration of result not sent or sent late

- Complementary document incomplete or with errors

- Insufficient reporting

- Refusal to produce list of associates or incomplete list

- Refusal to produce the list of subsidiaries and participations or incomplete list

- Sending the declaration by means other than electronic means

She is liable to a fine equal to 5% amounts omitted when these documents are not produced or when they contain errors.

The company is taken automatically, no later than the 15th of the month, an advance payment calculated on the basis of the profits declared in respect of the past year.

To determine the amount of tax, the progressive scale of income tax shall be applied to those profits.

If the company so wishes, its installments can be taken every 3 months by 15 February, 15 May, 15 August and 15 November. She must then opt no later than 1er October of the year preceding the year in which the option applies. This option is to be formulated with the company Tax Office (SIE) on which it depends:

The option is automatically renewed.

To terminate the option, the company must report it to the SIE: titleContent no later than 1er October of the year preceding the year in which the company wishes to waive the option.

When a company is subject to a tax regime based on the amount of its turnover, it has the option of opting for a more stringent tax regime. In other words, it can opt for the regime that would apply if it exceeded the maximum turnover threshold of the regime to which it is subject.

In the case of non-commercial profits (NCB), only the micro-entrepreneur has the possibility to change the tax regime by opting for the controlled reporting regime.

He must opt for the controlled return system within the period prescribed for filing the income tax return for the year in respect of which he is claiming to be taxed under this system.

Example :

A micro-entrepreneur deposits in May 2026 its income statement for the 2025 financial year. At the time of filing, it opts for the controlled declaration that will apply to the 2025 fiscal year.

The option is valid 1 year and is automatically renewed every year.

For y give up, it must also denounce the option at the time of its declaration of result for the year preceding that in which it no longer wishes to benefit from the controlled declaration scheme.

Who can help me?

The public service accompanying companies

Do you have a project, a difficulty, a question of everyday life?

Simple and free: you are called back within 5 days by THE advisor who can help you.

Regime of controlled reporting

Special regime for NCOs (micro NCOs)

NCO declarations

Online service

FAQ

Ministry of Finance