Company Property Tax (CFE)

Verified 17 February 2025 - Legal and Administrative Information Directorate (Prime Minister), Ministry of Finance

Company Property Tax (CFE) is a local tax payable by any company and person engaged in a self-employed occupation, unless exempted. A specific regime shall apply to new companies in the year of their creation.

General case

General case

The companies' property contributions must be paid by the businesses and by sole proprietors (including micro-entrepreneurs), including those working at home or with their customers.

In order to be liable to the EWC, the taxpayer's activity must meet the following conditions:

- The activity is carried out in France

- The activity has a habitual character : it is exercised repeatedly.

- The activity shall be carried out at professional title : This excludes non-profit activities and persons who are limited to the management of their private assets.

- The activity is self-employed person : Employees are not covered by the EWC

Please note

Individual businesses and entrepreneurs must pay the CFE regardless of their legal status, the nature of their activity, their tax regime and their nationality.

Rental and sub-rental of buildings

The activities of renting or sub-renting buildings are concerned by the CFE under the following conditions:

- Rental or sub-rental of naked buildings, provided that it generates a turnover or gross revenue excluding tax of at least €100,000. By contrast, the CFE does not concern the rental and sub-rental of buildings naked for residential use.

- Rental or sub-rental of furnished buildings, provided that it generates a turnover or gross revenue excluding tax of more than €5,000. The CFE does not concern the furnished rental of certain dwellings which are part of the principal residence from the owner.

Please note

The person liable for payment of the CFE may be a company or a individual.

Taxpayers can be exempt from payment of the CFE by right (automatically) or optional (upon request, with community approval).

FYI

A company is exempt from CFE in the year of its creation (only until 31 December of the current year). Then, the tax base is cut in half the following year.

Exemptions by right

The following individuals and organizations are exempt from the TFC by right and in permanent :

- Craftsmen and craftsmen working either for individuals with materials supplied or on their behalf with materials belonging to them, whether or not they have a sign or shop, when they use only the apprentice competition(s) aged 20 years or less at the beginning of the apprenticeship. They can get help from their Civil partnerships, partners and children.

- Taxi or ambulance drivers, owners or tenants of 1 or 2 cars, maximum 7 seats (excluding the driver's seat), whether they drive or manage themselves, provided that the 2 cars are not in service at the same time and that they respect the statutory tariffs

- Independent Home Sellers (VDI), for their total gross remuneration of less than €7,772

- Cooperatives and unions of businesses cooperatives of craftsmen, cooperatives businesses and unions of businesses cooperatives of boatmen, maritime cooperatives businesses

- Major seaports, autonomous ports, ports managed by local and regional authorities, public establishments or businesses with mixed economies (except recreational ports)

- Certain fishermen, artisanal fishing businesses and maritime registrants

- Farmers, certain employer groups and certain GIE: titleContent

- Certain agricultural cooperatives and their unions

- Zoological establishments for their agricultural activity (animal care and educational shows and activities)

- Co-operative and Participatory businesses (Scop)

- Private institutions of first and second degree education under contract with the State and of higher education under contract or recognized as being of public interest

- Teachers of humanities, science and the arts of pleasure and primary teachers who teach personally, either at home or at the home of their pupils, or in a room without a sign and without special facilities

- Painters, sculptors, engravers and draftsmen considered as artists and selling only the product of their art. This includes graphic artists provided that their activity is limited to the creation of graphic works.

- Photographers and authors, for their activity relating to the production of photographs and the transfer of their works of art or copyright

- Authors, composers, choreographers, copyright translators, and certain categories of performing artists (live performances)

- Lyrical and dramatic artists

- Press activities: periodical publishers, online press services, specialist press broadcasters

- Midwives and caregivers (unless they are nurses)

- Lawyers who have followed the training course sanctioned by the CAPA, the exemption is limited to 2 years from the start of activity

- Doctors and health workers opening a sub-office in a medical desert or in a commune of less than 2,000 inhabitants

- Sportsmen for the sole practice of a sport

- Professional unions, whatever their legal form, and their unions for their activities relating to the study and defense of the collective material or moral rights and interests of their members or of the persons they represent

- HLM organizations and owners or tenants renting or subletting part of their personal dwelling occasionally at a reasonable price (or furnished, provided that the dwelling is the sub-tenant's principal residence)

- Operators of classified tourist furniture or bed and breakfasts (unless otherwise decided by the municipality), provided that these premises form part of their personal dwelling (main or secondary residence outside the rental periods) and do not constitute the principal or secondary dwelling of the tenant

- Companies for their biogas, electricity and heat production through methanization

- Social activities (except mutual societies, their unions, and provident societies)

- Companies created in a urban basin to be dynamised (BUD) between 1er January 2018 and December 31, 2022 and are exempt from income tax or business tax. The exemption is limited to 7 years from the creation.

- Companies located in a Priority Development Area (PRA) between 1er January 2019 and December 31, 2022 and are exempt from income tax or business tax. The exemption is limited to 7 years from the creation.

- Local and regional authorities, public institutions and government bodies

Optional exemptions

Optional exemptions shall be subject to approval of recipient communities of the contribution. These exemptions are generally temporary.

The companies benefiting from the optional exemption from CFE are:

- Companies located in the following areas:

- Regional aid zones (RBAZs)

- Investment aid zones for small and medium-sized companies

- Rural Revitalization Areas (ZRR) and areas France ruralités revitalization (FRR)

- Sensitive urban areas (SZs)

- Priority areas of city policy (QPV)

- First generation urban free zones

- Second generation urban free zones

- Urban Free Zones-Third Generation Entrepreneurs

- Defense Restructuring Areas (ZRD)

- Employment pools to be revitalized (BER)

- Free zones of activities (FZs) in Guadeloupe, French Guiana, Martinique, Reunion or Mayotte - Companies located in Corsica

- Rural doctors, paramedics and veterinarians

- Young Innovative companies (JEI) and young university companies (JEU)

- Independent record shops (mainly engaged in the retail sale of phonograms)

- Retail establishments selling new books with reference independent library label

- live performance companies national theaters, theatrical tours, symphony concerts, musical performances and varieties

- Municipal credit unions

Where the taxpayer is entitled to an exemption, he shall make an application, as the case may be, in the statement no. 1447-M-SD (amending declaration) or in theAnnex No 1447-E Attach to Declaration No. 1447-M-SD.

In addition, the company must attach a statement no. 1465-SD where the exemption concerns regional aid areas, investment aid areas for small and medium-sized companies and rural regeneration areas.

The application must be made to the company Tax Office (SIE) on which it is based.

Amending Declaration 1447-M-SD (CFE)

Amending Declaration, Annex 1447-E (CFE)

Specific amending declaration 1465-SD (CFE)

In addition, on the deliberation of the municipalities, the establishment creations and extensions may be exempted from tax for a period of 3 years from the year following the year in which it was created or frome year following the year in which the extension of establishment occurred.

The creation of an establishment means any new establishment of a company in a municipality where it is not regarded as a change of operator.

The extension of establishment means the net increase in the taxable amount compared with that of the previous year multiplied by the coefficient, applicable for the reference period of the CFE, either of annual updating of the rental values for business premises or of annual flat-rate increase for industrial establishments.

In order to benefit from this exemption, the company must also statement no. 1447-M-SD, for each exempt establishment, to be sent to the tax department to which the establishment is subject. It has to be done before 1er May of the year following that in which the establishment was extended.

The companies liable to pay the CFE are not not required to report annually their tax bases.

However, 1447-M statement-SD shall be carried out by the company in any of the following :

- The company claim for exemption : land use planning, live performance companies or young innovative company, for example

- The company wants to report a change elements known to the administration, in particular:

- Increase or decrease in space area

- Change in the number of employees (tax credit, artisan reduction...)

- Variation of a taxing element (power or number of installations)

- Threshold Exceeded €100,000 turnover (for naked rental activities)

- Termination or closure of an installation or establishment

The declaration must be addressed to the company tax department (SIE) on which the company depends before the 2nde working day following 1er May (until May 3, 2024 for the 2025 CFE).

Calculation of the CFE

The CFE is calculated differently depending on whether the company has premises (or land) for the exercise of its activity.

Company with premises or land

The CFE is calculated against the rental value of immovable property subject to the property tax which the company used for its professional activity during the penultimate year (year N-2).

Example :

The calculation of the 2023 EFC shall take into account the commercial premises used in 2021 for the business purposes.

A variable rate depending on the municipality (where the company has its principal place of business) is applied to the rental value to determine the amount of the FTC.

FYI

The tax administration shall make available a new tool to view the tax rate applicable to your municipality. Simply enter an accounting year, your region, and then your department.

However, if the rental value of the premises is too low, the company must pay a minimum contribution. In this case, the amount of the CFE shall be determined based on turnover carried out over a period of 12 months (in year N-2).

In each tranche, the minimum CFE base and the applicable rate vary according to the municipality in which the company is domiciled. In other words, for the same turnover, 2 companies located in 2 different municipalities will not pay the same amount of CFE.

Please note

Where a company has more than one institution, the CFE established on a minimum basis shall be due to the place of main establishment. It's not always the head office.

Turnover made of N-2 | Minimum CFE base due in 2024 (according to municipality) | Minimum CFE base due in 2025 (depending on the municipality) |

|---|---|---|

Enter €5,001 and €10,000 | Enter €237 and €565 | Enter €243 and €579 |

Enter €10,001 and €32,600 | Enter €237 and €1,130 | Enter €243 and €1,158 |

Enter €32,601 and €100,000 | Enter €237 and €2,374 | Enter €243 and €2,433 |

Enter €100,001 and €250,000 | Enter €237 and €3,957 | Enter €243 and €4,056 |

Enter €250,001 and €500,000 | Enter €237 and €5,652 | Enter €243 and €5,793 |

From €500,001 | Enter €237 and €7,349 | Enter €243 and €7,533 |

FYI

The company is exempt from the minimum contribution if its annual turnover does not exceed €5,000.

Company without premises or land

If the contractor has no premises and carry on business at home (or with its customers), the latter is nevertheless liable to the CFE. In this case, the amount of the CFE shall be determined based on turnover carried out over a period of 12 months (in year N-2).

In each tranche, the minimum CFE base and the applicable rate vary according to the municipality in which the company is domiciled. In other words, for the same turnover, 2 companies located in 2 different municipalities will not pay the same amount of CFE.

FYI

The tax administration shall make available a new tool to view the tax rate applicable to your municipality. Simply enter an accounting year, your region, and then your department.

The place of domicile of the company may correspond to the dwelling place of the sole trader or at another location in application of a contract of commercial domiciliation.

Turnover made of N-2 | Minimum CFE base due in 2024 (according to municipality) | Minimum CFE base due in 2025 (depending on the municipality) |

|---|---|---|

Enter €5,001 and €10,000 | Enter €237 and €565 | Enter €243 and €579 |

Enter €10,001 and €32,600 | Enter €237 and €1,130 | Enter €243 and €1,158 |

Enter €32,601 and €100,000 | Enter €237 and €2,374 | Enter €243 and €2,433 |

Enter €100,001 and €250,000 | Enter €237 and €3,957 | Enter €243 and €4,056 |

Enter €250,001 and €500,000 | Enter €237 and €5,652 | Enter €243 and €5,793 |

From €500,001 | Enter €237 and €7,349 | Enter €243 and €7,533 |

FYI

The company is exempt of CFE if its annual turnover does not exceed €5,000.

Reduction of the tax base

For the calculation of the CFE, the rental value is small from:

- 30% for industrial establishments

- 50% for pollution abatement facilities: local authorities may increase this reduction to €100.

- 50% for energy-saving or noise-reducing equipment: local authorities may increase this reduction to 100%.

- 1/3 for airports

- 100% for specific port handling facilities or facilities which have been the subject of a transfer of rights in rem to a terminal operator, for the first 2 years in respect of which the goods enter the taxable amount of that operator. The rate shall be reduced to €75, 50% and 25% for each of the following 3 years.

- 25% in case of establishment in Corsica

Please note

For seasonal companies, the total rental value of property subject to property taxation is reduced according to the period of inactivity (e.g. restaurants, cafes).

In addition, the company liable to pay the CFE benefits from a reduction of its tax base (rental value or turnover) in the following cases:

- Craftsman (not fully exempt from CFE) employing up to 3 employees: reduction of 75% per 1 employee, 50% for 2 employees and 25% for 3 employees (excluding apprentices). This reduction applies on condition that the remuneration for work (profit, wages paid and social contributions) represents more than 50% of the craftsman's overall turnover including VAT.

- If established in Corsica: reduction of 25%

Please note

In the year following their creation, the new companies benefit from a reduction of 50% their tax base.

Additional tax and management fees

In addition to the amount of the CFE thus calculated, there is a additional fee to the CFE. It is fixed at 1.12% of the amount of the CFE and cashed for the benefit of CCI France and the regional chambers of commerce and industry.

Some companies are exempt of this tax:

- Craftsmen registered in the trades register and not included on the voters list of the chamber of commerce in their riding

- Agricultural cooperatives and Sica

- Fishermen and artisanal fishing businesses

- Furnished rentals

- Head of institution and pensioner

In addition, the company must pay management costs of local taxation equivalent to 1% the amount of the CFE and the additional tax.

FYI

In the end, the amount to be paid by the company is calculated as follows: CFE due + additional tax + management fees.

Example :

A company is liable to €5,500 under the CFE. The additional tax is therefore €61.60. The management fees are added, they are set at about €55.60 (ie 1% 5,500 + 61.60).

In total, the company must pay an amount of €5,617.20.

The company liable to pay the CFE shall receive a paperless tax notice (and not by mail) on its online tax account. This tax notice indicates the amount of the CFE and the time limit for settling it.

Payment terms vary by amount of CFE settled in the previous year by the company.

CFE less than or equal to € 3 000

The amount of the CFE has to be paid no later than 16 December 2024 (inclusive).

FYI

Where the deadline for payment or withdrawal of the CFE coincides with a Saturday, Sunday or public holiday, it shall be extended to 1er working day next.

The company has the choice between the following payment methods:

- Internet payment : Default payment method, the company itself makes the online payment of the contribution. This mode is mandatory for companies covered by the DGE.

- either via the online tax account

- either via the Portailpro account

- Monthly levy : payment method on option, the company is automatically charged every 15th of the month from January to October. Each levy corresponds to one tenth of the amount of the CFE. The option is available until June 30.

- Pick at maturity : payment method on option, the company is automatically debited at maturity. The option is available until November 30.

CFE over €3,000

The company must pay a down payment equal to 50% of the CFE paid in the previous year. The amount of the deposit is indicated on a notice of advance payment dematerialized, available on the online tax account or the Portailpro account company.

The deposit has to be paid between may 31 and june 17, 2024.

The remaining balance of the EFC has to be settled by 16 December 2024 (inclusive).

FYI

Where the deadline for payment or withdrawal of the CFE coincides with a Saturday, Sunday or public holiday, it shall be extended to 1er working day next.

The company has the choice between the following payment methods:

- Internet payment via the online tax account : Default payment method, the company itself makes the online payment of the contribution. This mode is mandatory for companies covered by the DGE.

- Monthly levy : payment method on option, the company is automatically charged every 15th of the month from January to October. Each levy corresponds to one tenth of the amount of the CFE. The option is available until June 15.

- Pick at maturity : payment method on option, the company is automatically debited at maturity. The option is available until 31 May for the deposit and until 30 November for the payment of the balance.

Please note

Since 1er January 2024, companies subject to CFE that resident abroad (e.g. bare premises rentals) can pay their CFE by transferdirectly from the Treasury account. This right shall apply to residents of States on a list defined by order.

In case of assignment or transfer of the company, the new operator must subscribe to a 1447-C-SD statement (initial declaration) before 1 January of the year following the year of the change. The declaration must be sent to the company Tax Office (SIE).

Initial Declaration 1447-C-SD (CFE)

Example :

In the event of a change of operator in 2023, the person liable must file the 1447-C return by 31 December 2023 for the establishment of the 2024 EWC.

If the change takes place during the year, the former operator remains liable for the full year. The new operator is then not taxable.

For the 2 years following the year of the change, the new operator is taxed on the rental value of the real estate that he disposed of (for the exercise of his activity) on December 31 of his first year of activity.

Please note

In case of cessation of activity during the year, the company is not liable to the CFE for the remaining months.

However, the CFE is due for classified installation for the environment (ICPE) in the process of ceasing activity during the period of site rehabilitation or restoration.

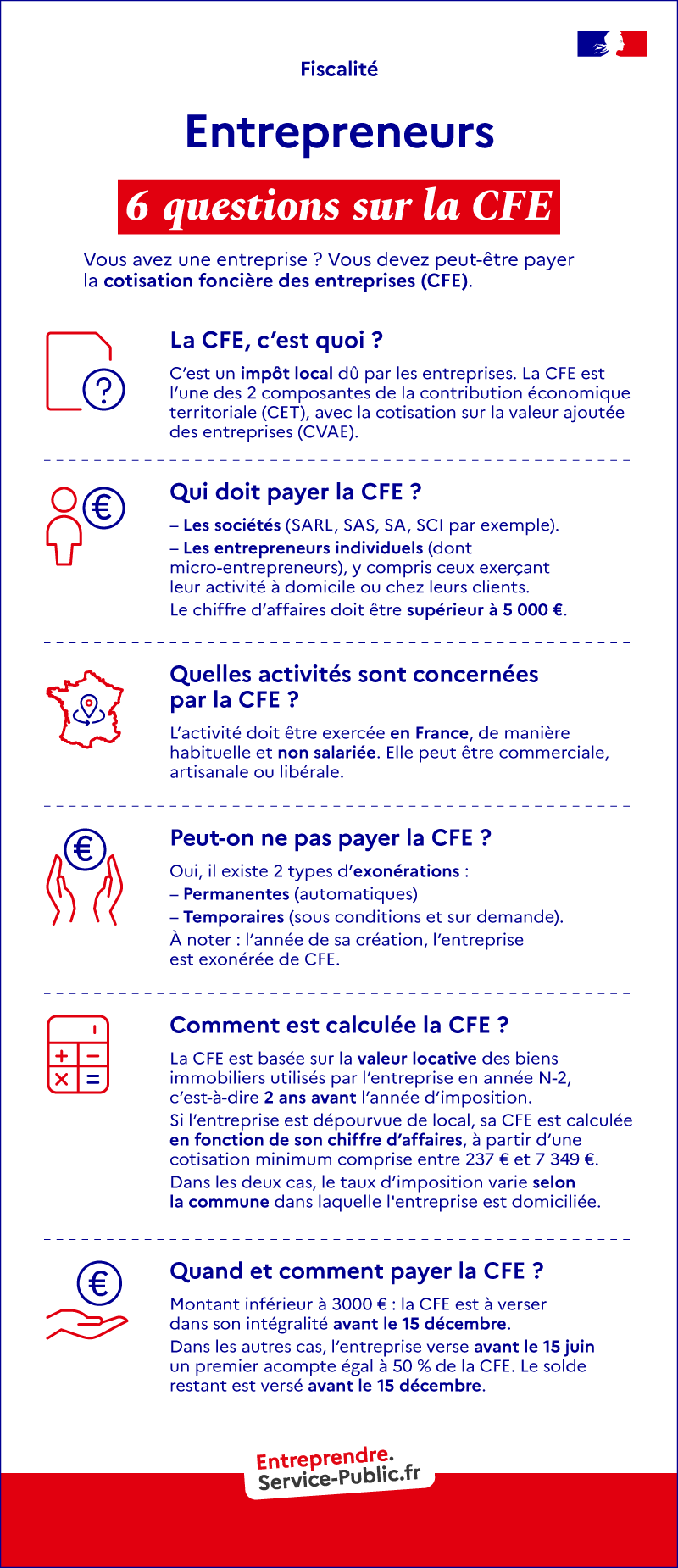

Infographie - 6 key questions on the CFE

Ouvrir l’image dans une nouvelle fenêtre

What's CFE?

It is a local tax payable by companies. The CFE is one of the two components of the territorial economic contribution (CET), together with the contribution on the value added of companies (VAAC).

Who has to pay the CFE?

- businesses (SARL, SAS, SA, SCI for example).

- Individual entrepreneurs (including micro-entrepreneurs), including those working at home or with their customers.Turnover must be higher than 5 000 €.

Which activities are covered by the CFE?

The activity must be carried out in France, in a habitual and self-employed manner. It can be commercial, artisanal or liberal.

Can we not pay the CFE?

There are 2 types of exemptions:

- Permanent (automatic)

- Temporary (subject to conditions and on request)

Note: the year of its creation, the company is exempt from CFE.

How is the CFE calculated?

The CFE is based on the rental value of real estate used by the company in year N-2, i.e. 2 years before the tax year.

If the company has no premises, its CFE is calculated on the basis of its turnover, from a minimum contribution of between €237 and €7,349.

In both cases, the tax rate varies according to the municipality in which the company is domiciled.

When and how to pay the CFE?

Amount less than € 3 000: the full amount of the CFE is due before 15 December.

In other cases, the company shall pay a first installment equal to 50 % of the CFE before 15 June. The remaining balance shall be paid before 15 December.

New company (created this year)

General case

The companies' property contributions must be paid by the businesses and by sole proprietors (including micro-entrepreneurs), including those working at home or with their customers.

In order to be liable to the EWC, the taxpayer's activity must meet the following conditions:

- The activity is carried out in France

- The activity has a habitual character : it is exercised repeatedly.

- The activity shall be carried out at professional title : This excludes non-profit activities and persons who are limited to the management of their private assets.

- The activity is self-employed person : Employees are not covered by the EWC

Individual businesses and entrepreneurs must pay the CFE regardless of their legal status, the nature of their activity, their tax regime and their nationality.

Rental and sub-rental of buildings

The activities of rental or sub-rental of bare buildings are concerned by the CFE when they generate a turnover or gross revenue excluding taxes of at least €100,000.

By contrast, the CFE does not concern the rental and sub-rental of buildings naked for residential use. The CFE does not concern the furnished rental of certain dwellings that are part of the owner's principal residence.

FYI

A company is exempt from CFE in the year of its creation (only until 31 December of the current year).

A company is exempt from CFE in the year of its creation (only until 31 December of the current year). It also benefits from a reduction in its tax base the following year.

The company must make the request in its statement no. 1447-C-SD (so-called initial declaration) addressed to the company Taxation Service (SIE) on which it depends.

Initial Declaration 1447-C-SD (CFE)

Thereafter, the company may possibly benefit from an exemption by right or optional (with community approval).

Exemptions by right

The following individuals and organizations are exempt from the TFC by right and in permanent :

- Craftsmen and craftsmen working either for individuals with materials supplied or on their behalf with materials belonging to them, whether or not they have a sign or shop, when they use only the apprentice competition(s) aged 20 years or less at the beginning of the apprenticeship. They can get help from their Civil partnerships, partners and children.

- Taxi or ambulance drivers, owners or tenants of 1 or 2 cars, maximum 7 seats (excluding the driver's seat), whether they drive or manage themselves, provided that the 2 cars are not in service at the same time and that they respect the statutory tariffs

- Independent Home Sellers (VDI), for their total gross remuneration of less than €7,772

- Cooperatives and unions of businesses cooperatives of craftsmen, cooperatives businesses and unions of businesses cooperatives of boatmen, maritime cooperatives businesses

- Major seaports, autonomous ports, ports managed by local and regional authorities, public establishments or businesses with mixed economies (except recreational ports)

- Certain fishermen, artisanal fishing businesses and maritime registrants

- Farmers, certain employer groups and certain GIE: titleContent

- Certain agricultural cooperatives and their unions

- Co-operative and Participatory businesses (Scop)

- Private institutions of first and second degree education under contract with the State and of higher education under contract or recognized as being of public interest

- Teachers of humanities, science and the arts of pleasure and primary teachers who teach personally, either at home or at the home of their pupils, or in a room without a sign and without special facilities

- Painters, sculptors, engravers and draftsmen considered as artists and selling only the product of their art

- Photographers and authors, for their activity relating to the production of photographs and the transfer of their works of art or copyright

- Authors, composers, choreographers, copyright translators, and certain categories of performing artists (live performances)

- Lyrical and dramatic artists

- Press activities: periodical publishers, online press services, specialist press broadcasters

- Midwives and caregivers (unless they are nurses)

- Lawyers who have followed the training course sanctioned by the CAPA, the exemption is limited to 2 years from the start of activity

- Doctors and health workers opening a sub-office in a medical desert or in a commune of less than 2,000 inhabitants

- Sportsmen for the sole practice of a sport

- Professional unions, whatever their legal form, and their unions for their activities relating to the study and defense of the collective material or moral rights and interests of their members or of the persons they represent

- HLM organizations and owners or tenants renting or subletting part of their personal dwelling occasionally at a reasonable price (or furnished, provided that the dwelling is the sub-tenant's principal residence)

- Operators of classified tourist furniture or bed and breakfasts (unless otherwise decided by the municipality), provided that these premises form part of their personal dwelling (main or secondary residence outside the rental periods) and do not constitute the principal or secondary dwelling of the tenant

- Companies for their biogas, electricity and heat production through methanization

- Social activities (except mutual societies, their unions, and provident societies)

- Companies created in an urban basin to be revitalized (BUD) between 1er January 2018 and December 31, 2022 and are exempt from income tax or business tax. The exemption is limited to 7 years from the creation.

- Companies located in a Priority Development Area (PRA) between 1er January 2019 and December 31, 2022 and are exempt from income tax or business tax. The exemption is limited to 7 years from the creation.

- Local and regional authorities, public institutions and government bodies

Optional exemptions

Optional exemptions shall be subject to approval of recipient communities of the contribution. These exemptions are usually temporary.

The companies benefiting from the optional exemption from CFE are:

- Companies located in the following areas:

- Regional aid zones (RBAZs)

- Investment aid zones for small and medium-sized companies

- Rural Revitalization Areas (ZRR) and areas France ruralités revitalization (FRR)

- Sensitive urban areas (SZs)

- Priority areas of city policy (QPV)

- First generation urban free zones

- Second generation urban free zones

- Urban Free Zones-Third Generation Entrepreneurs

- Defense Restructuring Areas (ZRD)

- Employment pools to be revitalized (BER)

- Free zones of activities (FZs) in Guadeloupe, French Guiana, Martinique, Reunion or Mayotte - Companies located in Corsica

- Rural doctors, paramedics and veterinarians

- Young Innovative companies (JEI) and young university companies (JEU)

- Independent record shops (mainly engaged in the retail sale of phonograms)

- Retail establishments selling new books with the independent reference bookshop label

- live performance companies national theaters, theatrical tours, symphony concerts, musical performances and varieties

- Municipal credit unions

Where the person liable is entitled to an exemption from CFE, he must apply for it, as the case may be, in the statement no. 1447-C-SD (initial declaration) or in theAnnex No 1447-E Attach to Declaration 1447-C-SD.

In addition, the company must attach a statement no. 1465-SD where the exemption concerns regional aid areas, investment aid areas for small and medium-sized companies and rural regeneration areas.

The application must be made to the company Tax Office (SIE) on which it is based.

Initial Declaration 1447-C-SD (CFE)

Initial Declaration, Annex 1447-E (CFE)

Specific amending declaration 1465-SD (CFE)

In addition, on the deliberation of the municipalities, the establishment creations and extensions may be exempted from tax for a period of 3 years from the year following the year in which it was created or frome year following the year in which the extension of establishment occurred.

The creation of an establishment means any new establishment of a company in a municipality where it is not regarded as a change of operator.

The extension of establishment means the net increase in the taxable amount compared with that of the previous year multiplied by the coefficient, applicable for the reference period of the CFE, either of annual updating of the rental values for business premises or of annual flat-rate increase for industrial establishments.

In order to benefit from this exemption, the company must make a statement no. 1447-M-SD to be sent to the tax department responsible for the establishment. It has to be done before 1er May of the year following that in which the establishment was extended.

L'year of its creation, the company must perform a 1447-C-SD statement (so-called initial declaration) in order to benefit from a total exemption from CFE.

The declaration is to be sent to the company tax office before 31 December so that the tax elements are established for the following year.

Tax base, exemptions, reductions

Business premises and industrial establishments

Minimum contribution

Online service

Online service